Let Customers Use Credit Memos to Pay Invoices—Right From the Customer Portal

2 Minute Read

Understanding Credit Memos in B2B eCommerce

In the B2B world, a credit memo is a formal credit issued to a customer—tied to a specific invoice—to rectify errors, make adjustments, process returns, and handle overpayments. They’re primarily used by customers on terms to pay down open invoices and are recorded and tracked inside the ERP. But applying them as a payment method—especially in an eCommerce environment—has traditionally required manual coordination through emails, phone calls, etc.

How Credit Memos Differ from Store Credit

In B2C, store credit is typically handled through vouchers or gift cards—flexible and untethered to a specific invoice. B2B credit memos, on the other hand, are structured financial instruments meant to reduce the balance on a terms account. They aren’t used as a credit during checkout, and most eCommerce platforms haven’t supported them as part of the digital payment experience.

Use Credit Memos to Pay Invoices—Directly in the Portal

Nomad gives your terms customers the ability to view and apply credit memos directly within the AR Portal—no extra steps, no manual follow-up, and no delays. The feature was developed in response to real-world feedback from our customer advisory group and works in lockstep with how your ERP is set up to manage credits.

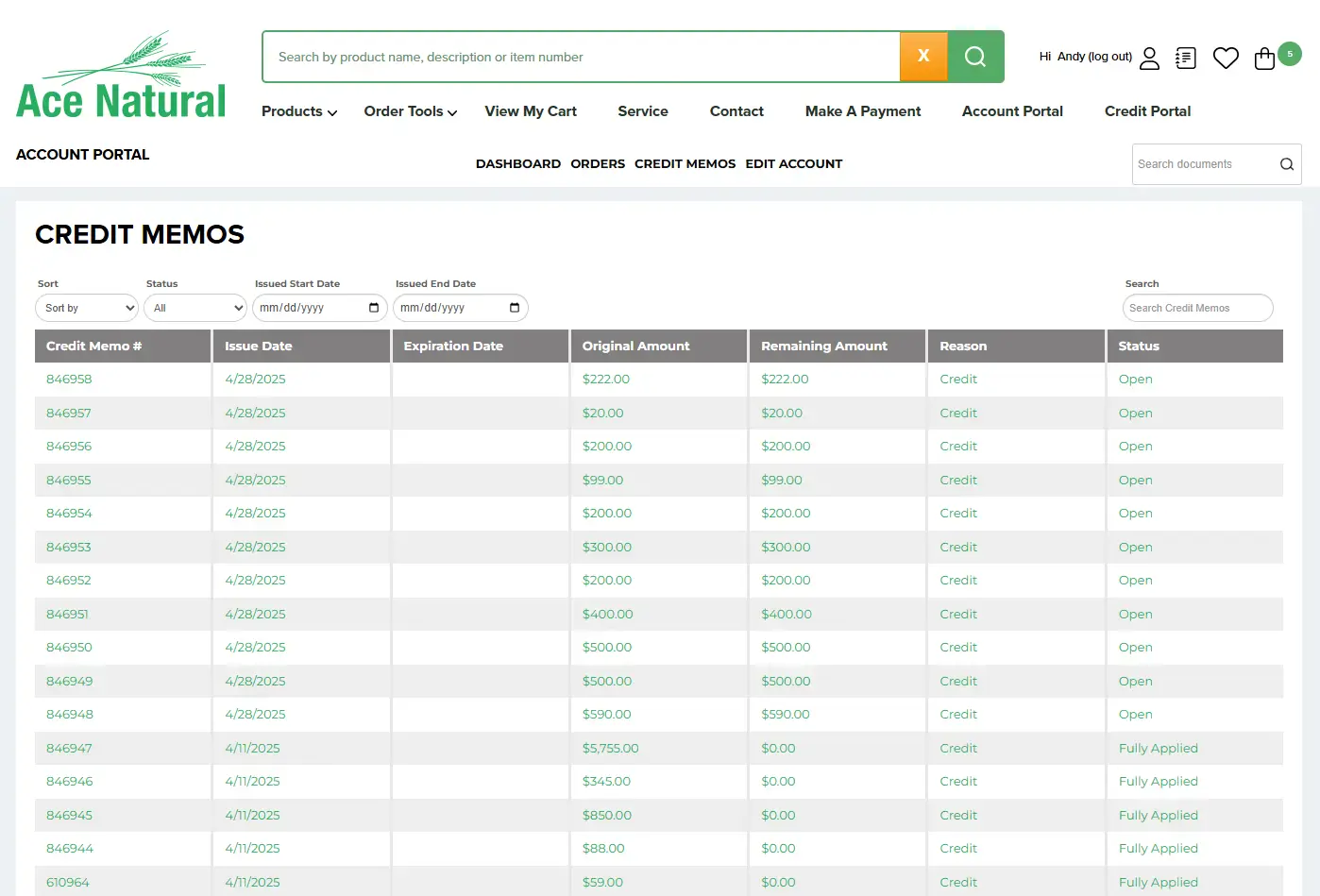

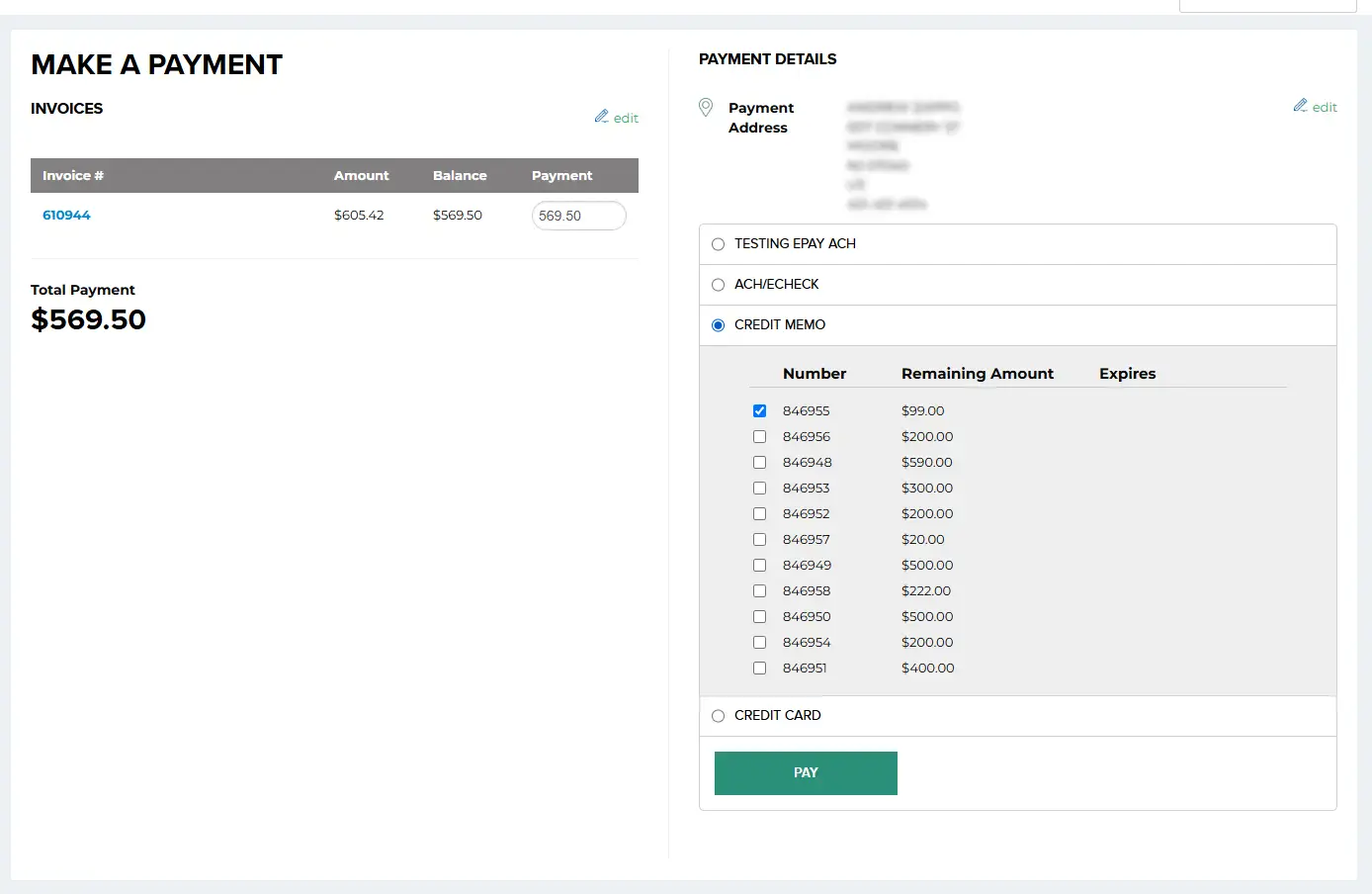

With Nomad, your customers can log into their account portal to:

- View a full list of open credit memos associated with their account.

- Open a detailed view of each credit memo, just as they would for an invoice.

- Apply an available credit directly to an outstanding invoice to pay it down.

Nomad is the eCommerce Platform That Reflects Your Financial Workflows

Self-service credit memo functionality is still rare in B2B eCommerce. Platforms like Shopify and BigCommerce can’t support it, and even platforms that market themselves as B2B-focused often lack this level of AR functionality.

With Nomad, you’re not just launching an eCommerce site—you’re extending your financial operations online in a way that mirrors how your business already works. That includes customer account-specific pricing, full support for complex payment terms, and now, the ability to manage and apply credit memos to open invoices.